The government of Andhra Pradesh faces a significant challenge in crafting the Budget for the fiscal year 2025-26, as it seeks to balance necessary infrastructure development and the fulfillment of important electoral commitments to attract investors.

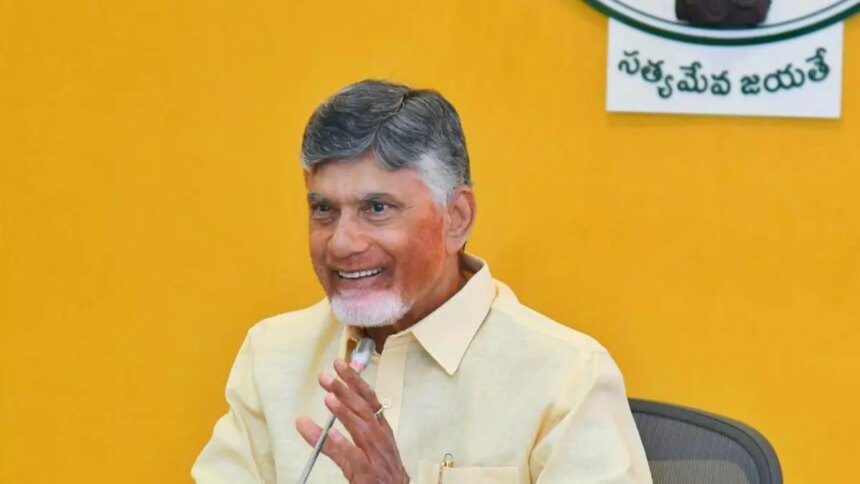

One of the key obstacles for the financially constrained State Government is the lack of robust support from the Central Government in its FY26 Budget, despite acknowledging the significance of advancing critical projects initiated by the previous NDA Government under N. Chandrababu Naidu.

The State Cabinet is poised to assess financial conditions and make pivotal decisions regarding budget allocations and the timing of the Budget presentation during a meeting scheduled for February 6. This upcoming Budget will be the first comprehensive one submitted by the NDA Government, following three interim Budgets introduced last year. These included one from the YSR Congress Government, which lost the electoral mandate in May, along with two from the NDA Government, which stated it required time to comprehend the financial implications left by the previous administration led by Y. S. Jagan Mohan Reddy.

According to the Fiscal Health Index 2025 released by NITI Aayog, the financial health of the State is concerning. Andhra Pradesh ranks 17th among all states in terms of fiscal wellness, scoring only 20.9 out of 100. The report urges the State Government to concentrate on improving the efficiency of capital expenditures, optimizing mandatory expenditures, diversifying revenue sources for greater resilience, and maintaining stringent fiscal discipline.

These insights bolster the State Government’s argument regarding the legacy of alleged financial mismanagement it has inherited from its predecessor. Since 2018-19, capital expenditures in both social and economic services have plummeted by 84.3% and 60.1%, respectively, cumulatively. Additionally, the State has consistently failed to meet its capital expenditure budget estimates. In the 2022-23 fiscal year, capital expenditure represented just 3.5% of total spending and 4.4% of overall borrowing, as noted in the study.

From 2018-19 to 2022-23, the growth of the State’s own tax revenue was only 6% per year on average. The portion of the State’s tax revenue that comes from its own sources has seen moderate improvement, rising from 64% in 2018-19 to 67% in 2022-23. However, the growth rate of this revenue has significantly slowed, declining from 17.1% in 2018-19 to 9.8% in 2022-23, according to NITI Aayog.

For Naidu, reversing these troubling trends and increasing the State’s tax revenue while simultaneously enhancing capital expenditures for infrastructure development will be a formidable task. Resources are also essential for the implementation of major electoral promises, such as providing free travel for women on State-run RTC buses, which is anticipated to incur costs of approximately ₹250 crore each month.

How Naidu will navigate these challenges and realize his vision for wealth creation, particularly through the development of the Greenfield capital in Amaravati and boosting the State’s non-tax revenue, remains to be seen in the upcoming budget.