In an effort to stabilize its struggling finances, Boeing has announced plans to raise up to $25 billion through stock and debt offerings, along with a $10 billion credit agreement with major lenders amidst production and regulatory challenges.

The announcement was made by Boeing on Tuesday.

The exact amount and timing of the capital raising are yet to be determined, but analysts believe Boeing may need to secure between $10 billion and $15 billion to maintain its credit ratings, which are currently just above junk status.

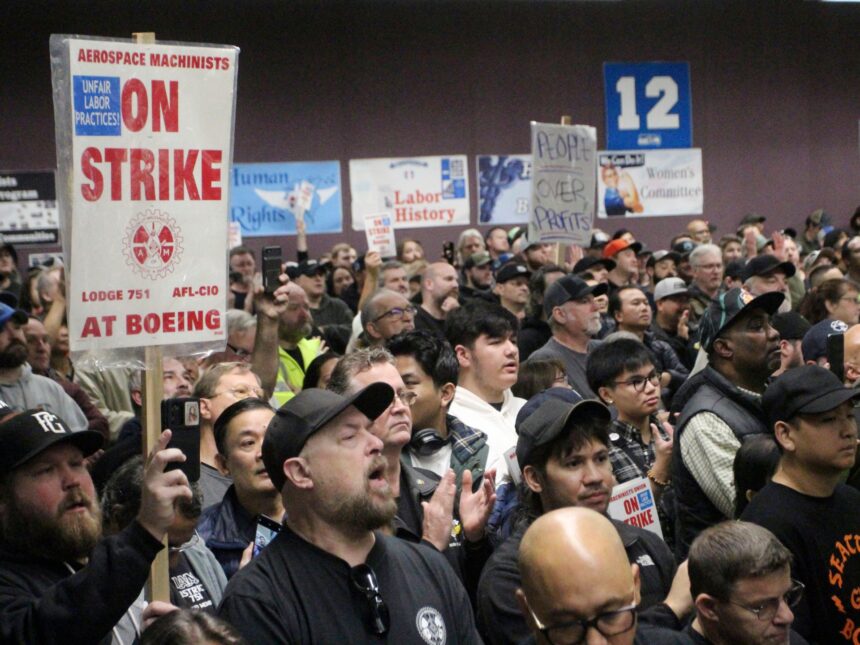

The company is facing a decrease in production of its popular 737 MAX jet following a recent mid-air incident and a strike by US union workers since September 13.

Boeing stated it has not utilized the new $10 billion credit facility provided by BofA, Citibank, Goldman Sachs, and JPMorgan, nor tapped into its existing revolving credit facility.

“These measures are prudent steps to enhance the company’s liquidity,” Boeing explained, adding that the potential stock and debt offerings would offer support for its balance sheet over a three-year period.

Boeing’s stock rose by 1.6 percent following the announcement.

S&P Global and Fitch had previously warned of a possible downgrade. They indicated that the stock and debt offerings could help safeguard Boeing’s investment-grade rating.

However, some analysts remain skeptical.

“We view the lack of specifics in the announcement and the need for temporary financing as a sign that potential investors or lenders may be hesitant,” stated Agency Partners analyst Nick Cunningham.

Cunningham suspended his recommendation and price target for Boeing’s shares.

Emirates Airlines president Tim Clark raised concerns about Boeing’s future, noting a potential investment downgrade and the looming threat of Chapter 11 bankruptcy if funds are not raised.

Boeing intends to utilize the funds for general corporate purposes as per documents filed with the US markets regulator.

With escalating costs due to the ongoing strike that is estimated to be costing the company over $1 billion per month, negotiations between Boeing and the Machinists Union have not led to a resolution.

Despite talks and federal mediation, a new contract agreement has not been reached, leading to increased tensions between striking workers and Boeing management.

US Representative Pramila Jayapal addressed the strikers, urging Boeing to prioritize fair contracts for its workers over executive bonuses and share buybacks.

“Let’s make Seattle Boeing town again!” Jayapal exclaimed to the cheering crowd, calling for an end to the strike for the benefit of both the workers and the company.