Unifi Asset Management Pvt Ltd, a subsidiary of Unifi Capital, has made a bold decision to differentiate itself in the mutual fund industry by only launching three mutual fund schemes over the next five years.

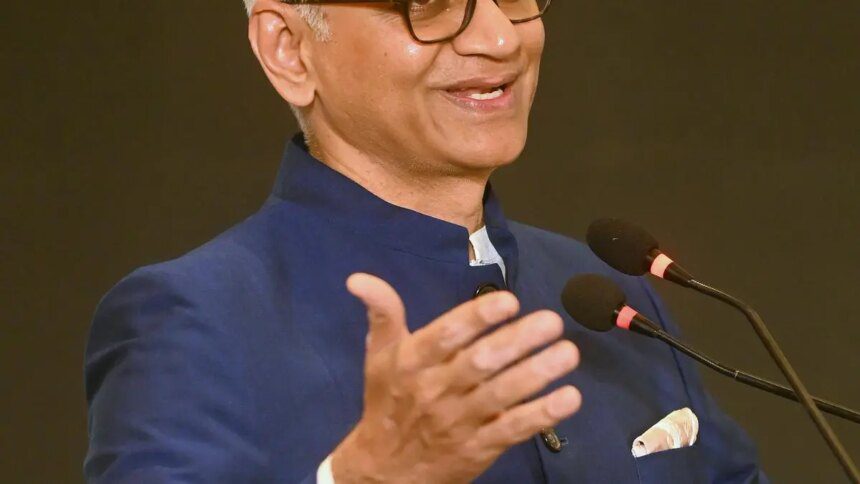

Speaking at an event, K Sarath Reddy, Chairman of Unifi Asset Management, emphasized the company’s commitment to excellence in a focused approach. The first scheme, Unifi Dynamic Asset Allocation Fund, opened for subscription from March 3-7, with plans to reopen on March 21. The fund garnered significant interest, attracting 2,200 participants within the first five days.

Upcoming offerings from Unifi include an equity-focused flexi-cap fund in May, covering large-, mid-, and small-cap stocks, and a hybrid fund by June or July, which will dynamically allocate between equity and debt.

Reddy highlighted that Unifi’s target market is the mass affluent segment, which consists of financially well-off individuals who are not yet at the level of investing ₹2 lakh in a single PMS. This growing segment includes professionals and self-employed individuals.

Addressing the challenge of investor retention in the face of market volatility, Reddy emphasized that Unifi will adopt a service-driven model, focusing on communication and investor education to reduce impulsive exits. Former SEBI chairman M Damodaran and Kishore Mahbubani, former President of the United Nations Security Council, spoke at the Unifi Mutual Fund launch event, endorsing Unifi’s strategic approach.

In conclusion, Unifi Asset Management’s unique strategy of launching only three funds in five years sets it apart in the mutual fund industry, with a strong emphasis on quality, service, and investor retention.