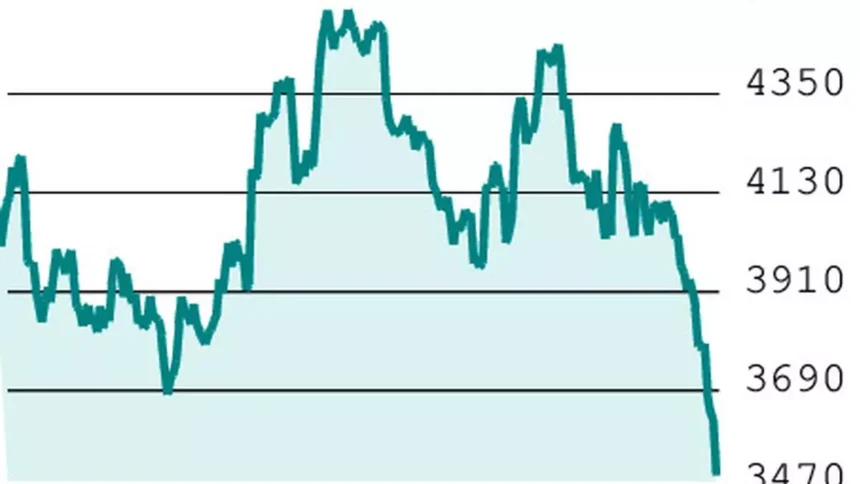

Tata Consultancy Services (TCS) stock (₹3,483.25) is currently at a crucial point after a significant decline. The immediate support levels are at ₹3,350 and a major support at ₹3,008. A close below ₹3,008 could change the long-term bullish trend for TCS.

There is an immediate resistance at ₹3,670, with a key resistance level at ₹3,964. Only a close above ₹3,964 can shift the current bearish sentiment for the stock. Overall, the stock is expected to trade within a range with an upward bias.

In the futures and options (F&O) segment, about 95% of positions were rolled over from February to March, significantly higher than the 3-month and 6-month averages of around 91-92%. There is some value buying observed as March futures for TCS are trading at ₹3,503.95, maintaining a healthy premium over the spot price.

For a trading strategy, we recommend buying the 3,500-call option on TCS, which closed at a premium of ₹82.80 on Friday. With a market lot of 175, this trade would cost approximately ₹14,490. The maximum loss would be the premium paid, i.e., ₹14,490, if TCS fails to close above ₹3,500 on expiry. The break-even point for this trade is ₹3,582.80.

Traders can target an initial profit of ₹150 for the TCS 3500-call option, with more aggressive traders setting a target of ₹200. It is advisable to avoid this strategy if the stock opens significantly lower.

A follow-up on the previous strategy for Tech Mahindra indicates that it failed due to a sharp decline in the stock triggering the stop loss.

Please note that these recommendations are based on technical analysis and F&O positions, and there is a risk of loss in trading.