Imported inflation has been gradually increasing since the beginning of the current financial year, after experiencing negative levels for several months. According to a recent analysis by the RBI, the contribution of imported inflation to the Consumer Price Index (CPI) inflation has risen by 0.5 percentage points since April. Strong foreign portfolio investment (FPI) inflows and effective currency management by the RBI could potentially strengthen the rupee and help mitigate imported inflation, experts suggest.

In August, of the total CPI headline inflation of 3.7%, 3.5% was attributed to domestic factors, while the remaining 0.2% was due to imported factors. This marks a shift from the negative contribution of imported components to overall CPI inflation that was observed since December 2022. The recent uptick in imported inflation is expected to continue as global prices are on the rise, potentially impacting core inflation, noted Madan Sabnavis, chief economist at Bank of Baroda.

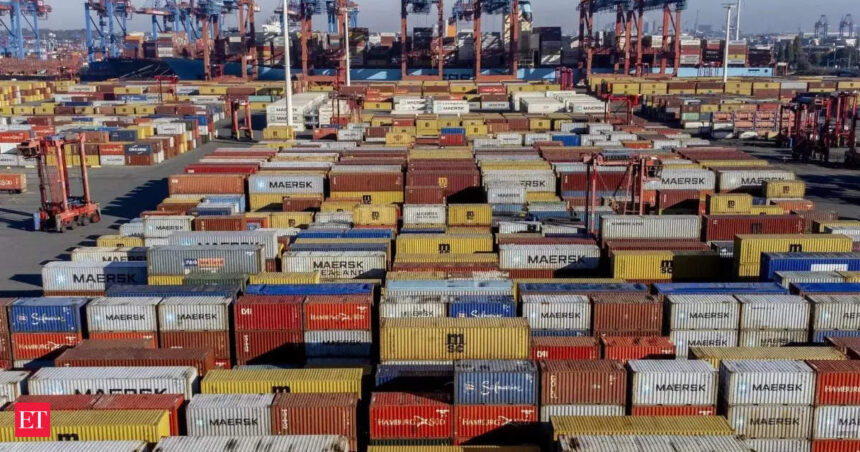

Key global commodities such as petroleum products, coal, electronic goods, gold, silver, chemical products, metal products, textiles, cereals, milk products, and vegetable oils play a significant role in driving domestic prices and imported inflation. Together, these items account for 36.4% of the CPI basket, as highlighted in the RBI’s latest monetary policy report. Imported inflation typically exerts upward pressure on overall CPI inflation when the domestic currency weakens against the US dollar, prompting the central bank to exercise caution in managing the rupee to prevent adverse effects on import prices in local currency.

Recent data from the RBI indicates that the rupee is considered overvalued by 4.7% relative to its intrinsic value in terms of real effective exchange rate as of September-end. The central bank will closely monitor the currency dynamics as imports are expected to rise, with FPI inflows potentially providing stability to the rupee exchange rate.