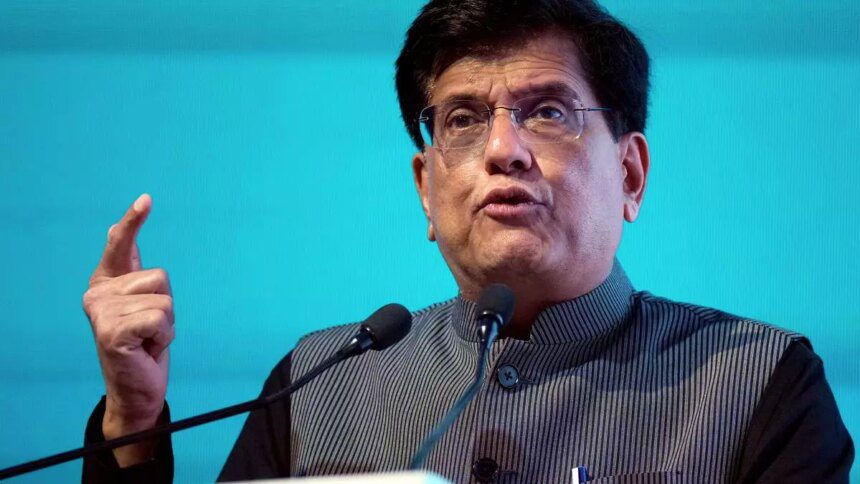

Union Minister Piyush Goyal believes that the Nifty 50’s valuation at 19 times FY26 earnings is reasonable, despite the ongoing market correction. Speaking at the Association of Mutual Funds of India Summit, Goyal acknowledged that there may still be room for some correction in the equity market.

He expressed concern about the high valuations of smaller companies, citing examples like a car dealer with soaring valuations based on the four-year bull run. Goyal emphasized the need to prevent such artificial run-ups in the future, urging mutual fund houses to guide investors appropriately and identify advisors giving bad advice.

Goyal praised domestic investors for their strength in the market, noting that with a mutual fund industry worth 70 lakh crore, foreign investors will not dominate the Indian market. He also mentioned that a free trade agreement with one country is almost finalized, with two more countries seeking similar pacts with India.

During another session, SEBI whole-time member Amarjeet Singh highlighted the role mutual funds can play in corporate governance, with AMFI driving industry growth. Goyal stressed the importance of mutual fund houses fulfilling their duty and responsibility by prioritizing investor guidance over returns.