Nippon Life India Asset Management (NAM India), the asset manager of Nippon India Mutual Fund (NIMF), has announced the launch of the Nippon India Active Momentum Fund. This open-ended equity scheme aims to generate long-term capital appreciation by investing in a diversified portfolio of equity and equity-related instruments. The NFO is set to open on February 10 and close on February 24, with a minimum investment amount of ₹500 and subsequent investments in multiples of ₹1. The benchmark for the fund is the Nifty 500 TRI.

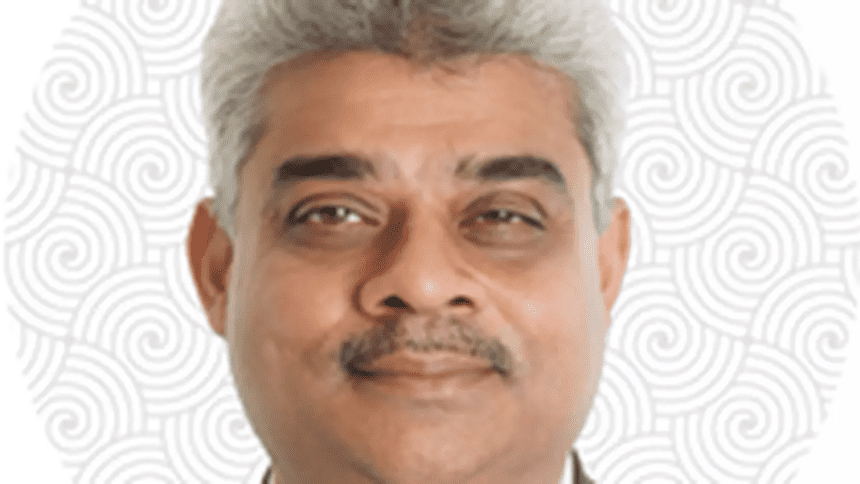

Saugata Chatterjee, Chief Business Officer at Nippon India Mutual Fund, expressed, “The Nippon India Active Momentum Fund offers a unique offering to the market by leveraging the alpha potential of momentum along with risk mitigation factors to enhance the investment experience. This strategic blend aims to ensure that investors benefit from riding high-quality momentum while minimizing risk. As an asset manager, we continuously strive to provide investors with distinct product strategies that cater to their risk appetite and investment objectives.”

The fund will leverage a combination of market wisdom (price momentum/technical views) and earnings revisions/fundamental research factors to achieve its objectives. Additionally, it may incorporate other factors such as minimum volatility and beta to help reduce portfolio risk during market downturns and enhance upside capture during uptrends, as stated in a press release.