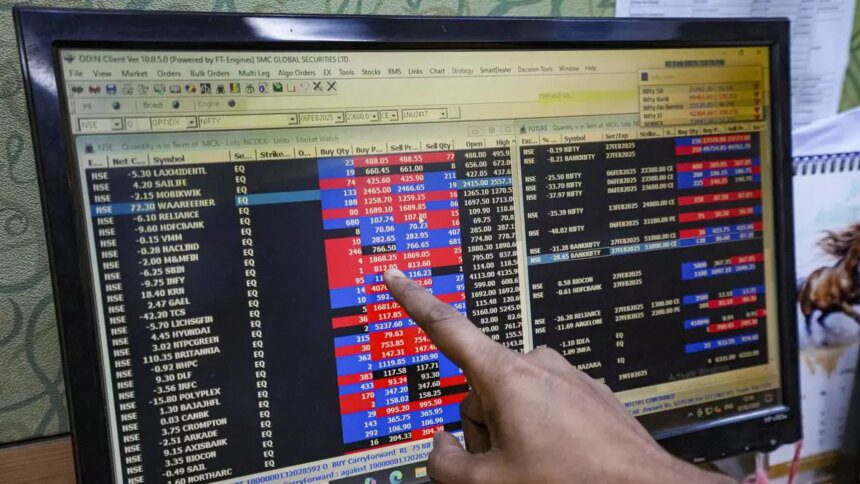

The Indian markets are expected to face continued pressure from bears as heavy FII selling persists. With the Gift Nifty indicating a gap-down opening of about 300 points at 22,690, the outlook remains bleak.

According to Puneet Singhania, Director at Master Trust Group, foreign investor sentiment remains weak with around $25 billion in FII outflows since the market peak in late September. This is driven by concerns over high valuations and a slowing economy, with India’s GDP growth projected to decelerate to a four-year low of 6.4 per cent in the current fiscal year. Institutional activity shows net FII outflows of ₹7,793 crore in the cash segment, while DII inflows stood at ₹16,582 crore, providing some support to the market.

A recent survey by BofA Research reveals a grim outlook for Indian stock markets. India has slipped to being the second-least favored market in Asia, with 19 per cent of fund managers underweight on Indian equities from a 12-month perspective, a significant increase from 10 per cent in January.

Vaibhav Porwal, Co-Founder of Dezerv, points out that since October 2024, India’s market cap has fallen by about $1 trillion while China’s has risen by $2 trillion, indicating a shift in FII flows. Data from NSDL shows that FPIs pulled out approximately ₹25,000 crore from Indian equities in January 2024 alone, in contrast to significant inflows in 2023.

Despite India’s strong long-term growth story, concerns over valuation and corporate earnings have led to profit-booking. India continues to trade at a premium compared to other emerging markets, prompting global investors to reassess their positions. Factors like a strong dollar attracting capital to US markets and sector-wise FPI outflows reflect the bearish sentiment in the market.

While seven sectors experience consistent outflows, the Reserve Bank of India’s liquidity injection measures are expected to provide some relief. By injecting rupee liquidity for a longer duration through a $10-billion dollar-rupee buy-sell swap arrangement, the RBI aims to stabilize liquidity and the rupee value.

Dilip Parmar, Research Analyst at HDFC Securities, believes that the swap mechanism can help stabilize the currency and market confidence during periods of foreign fund outflows, preventing excessive volatility in the exchange rate. The spot USDINR is expected to move towards 86.30.

In conclusion, the Indian markets are facing challenges from both domestic and global factors, but measures like RBI’s liquidity injection could offer some respite in the near term.