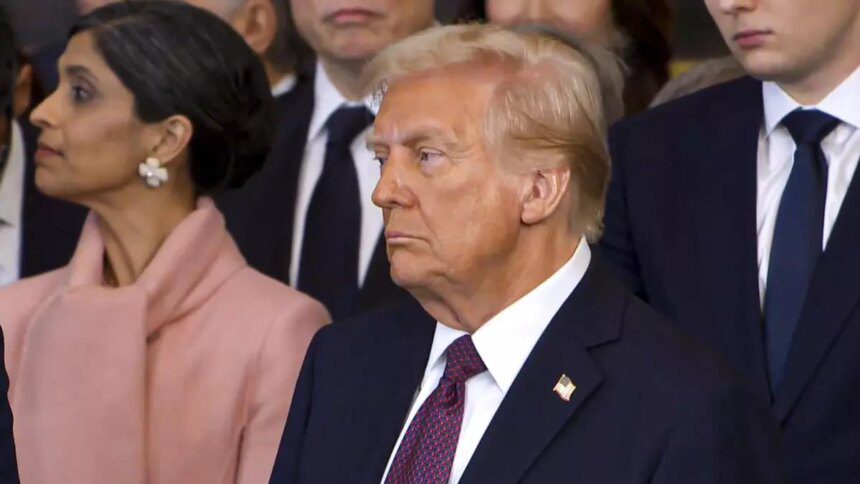

Investors showed positive reactions to Donald Trump’s second inauguration, anticipating a business-friendly agenda while remaining cautious about his protectionist trade policies, particularly on tariffs. Trump’s speech led to an increase in stock futures, with contracts on major indices trading higher. The dollar weakened as the administration hinted at no new tariffs on the first day.

Capital Economics’ James Reilly expects continued volatility but anticipates a rally in the US dollar and equities in Trump’s first year. The market is closely watching Trump’s actions on trade, immigration, tax cuts, and cryptocurrency regulation, with investment managers adjusting portfolios accordingly.

CFRA Research’s Sam Stovall highlighted the uncertainty surrounding Trump’s tariffs and other policy decisions. State Street Global Advisors’ Michael Arone believes the initial impact might be less severe than expected. However, concerns remain about inflation, regulation changes, and their impact on the market.

Wall Street CEOs have expressed optimism about a business-friendly administration, expecting loosened regulations and tax cuts. The S&P 500’s post-election rally has slightly cooled, influenced by inflation concerns. Trump plans to kick-start his term with executive orders focusing on immigration and energy.

The cryptocurrency industry is hopeful for Trump’s support, despite no specific mention in his speech. The S&P 500 saw a significant rise during Trump’s first term, albeit with bouts of volatility due to the trade war with China. The markets will be closed on Martin Luther King Jr. Day, delaying the full reaction to Trump’s inauguration until Tuesday.