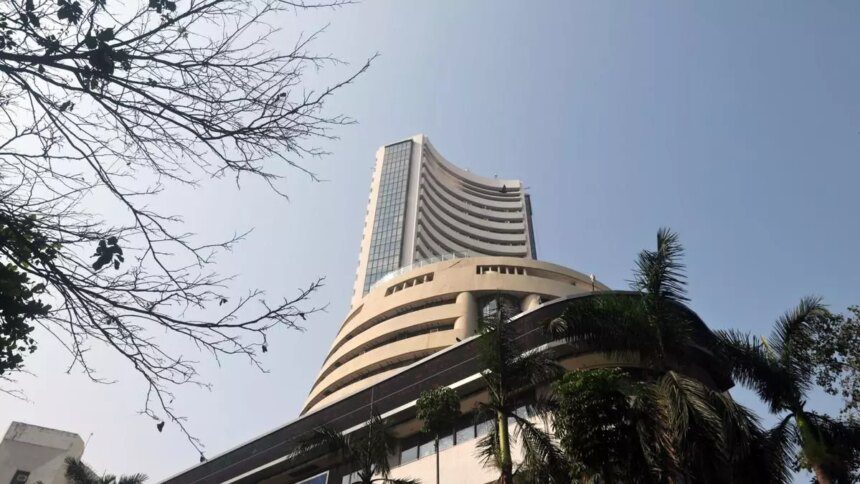

Equity markets saw a decline in mid-day trading on Wednesday, with banking and FMCG stocks dragging down sentiment following the RBI’s monetary policy announcement. The BSE Sensex dropped 156.96 points or 0.20 percent to 77,901.20, while the NSE Nifty fell 30.50 points or 0.13 percent to 23,572.85 at 12.40 PM.

Market breadth was negative, with 2,110 stocks declining compared to 1,629 advances on the BSE. There were 73 stocks hitting their 52-week lows and 49 touching their 52-week highs. Circuit filters were triggered for 179 stocks on the lower end and 145 stocks on the upper end.

The Nifty Bank index decreased by 0.57 percent to 50,093.65, putting pressure on banking stocks. The financial services sector also saw a decline, with its sectoral index dropping 0.58 percent to 23,523.60. State Bank of India and ICICI Bank fell by 1.63 percent and 1.19 percent, respectively.

On the positive side, Bharti Airtel was the top gainer on the NSE, surging by 4.36 percent. Metal stocks Tata Steel and JSW Steel also saw gains of 3.48 percent and 2.97 percent, respectively. Retail chain Trent and ITC Hotels rose by 3.05 percent and 2.84 percent, respectively.

However, FMCG major ITC continued its downward trend, falling by 2.05 percent due to disappointing third-quarter results. Apollo Hospitals and Bharat Electronics Limited (BEL) also experienced declines of 1.47 percent and 1.20 percent, respectively.

The mid-cap segment showed resilience, with the Nifty Midcap Select index gaining 0.52 percent to reach 12,035.65. The Nifty Next 50 remained stable, with a marginal decline of 0.02 percent to 63,527.15.

Investors are closely watching the implications of the RBI’s rate cut, which reduced the repo rate by 25 basis points to 6.25 percent. This decision comes amidst moderating inflation and expectations of sustained economic growth, as highlighted in the recent Economic Survey projecting 6.4 percent GDP growth for FY25.