Jindal Steel and Power (JSP) saw its shares decline by 6.36 per cent to ₹786.65 on the NSE today following a 51 per cent year-on-year drop in consolidated profit after tax to ₹951 crore for the third quarter ending December 2024. The stock hit an intraday low of ₹723.35.

The steel manufacturer reported flat consolidated gross revenue of ₹13,707 crore compared to ₹13,698 crore in the corresponding quarter last year. Adjusted EBITDA decreased by 24 per cent year-on-year to ₹2,133 crore after considering a one-off foreign exchange gain of ₹51 crore during the quarter.

As of December 31, 2024, the company’s net debt increased to ₹13,551 crore from ₹12,464 crore in September 2024. Consequently, the net debt to EBITDA ratio rose to 1.40x from 1.21x in the previous quarter.

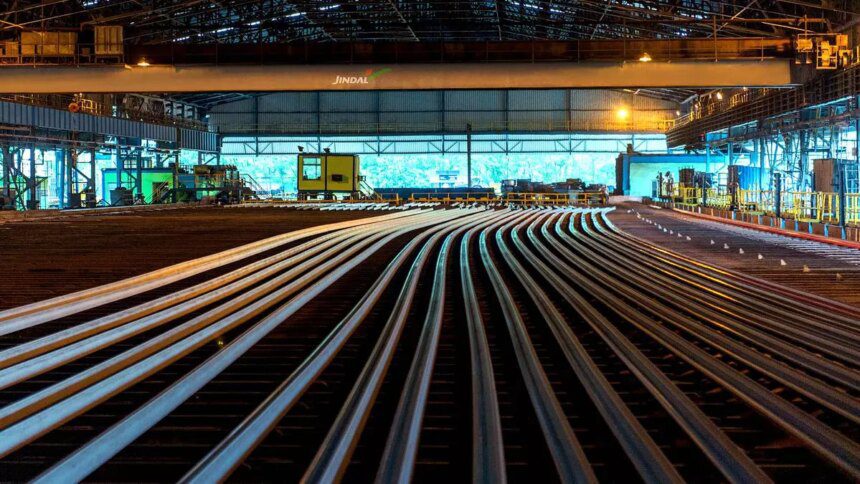

In terms of operations, steel production grew by 3 per cent year-on-year to 1.99 million tonnes, while sales volume increased by 5 per cent to 1.90 million tonnes. Exports accounted for 7 per cent of the total during the quarter. The company also reported a capital expenditure of ₹2,857 crore for the quarter, primarily directed towards expansion projects at its Angul facility.

Overall, JSP’s financial results for the third quarter were impacted by the decline in profit, but the company remains focused on operational growth and strategic investments for the future.