ITC Hotels shares are scheduled to be listed for trading on the BSE and NSE on January 29, according to a filing by ITC Ltd to the stock exchanges on Monday. The demerger of ITC Hotels’ business was fixed for January 1, 2025, with a record date of January 6 for the allocation of equity shares to ITC Ltd shareholders.

The board of directors of ITC Hotels allocated around 125.12 crore equity shares of Re 1 each to ITC Ltd shareholders based on a share entitlement ratio of 10:1. The National Company Law Tribunal (NCLT) approved the scheme of arrangement between ITC Ltd and ITC Hotels Ltd on October 4, 2024.

The listing of ITC Hotels shares is expected to take place on or before February 2025, with an estimated price range of ₹100-125 per share. The new entity will be majority-owned by ITC Ltd shareholders, with the conglomerate retaining a 40% stake. Analysts project strong growth potential for ITC Hotels in the luxury hospitality sector, with a focus on expanding its hotel portfolio and revenue.

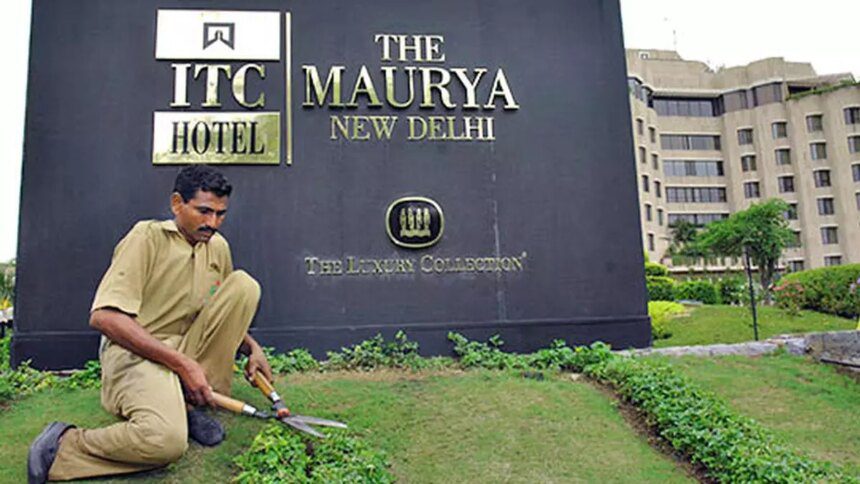

The reorganization is expected to benefit ITC’s hospitality business by leveraging its brand equity and goodwill. ITC Hotels currently operates 140 properties across luxury, premium, and budget segments, with plans to expand to 200 hotels and 18,000+ keys by 2030. Centrum Broking forecasts a revenue CAGR of 13.8% and an EBITDA margin of around 35% for ITC Hotels.

ITC Ltd’s stock closed at ₹440 per share on Monday, down 0.34% from the previous close. The listing of ITC Hotels shares is anticipated to unlock substantial shareholder value and drive growth in the luxury hotel segment.