The IPO of Denta Water and Infra Solutions, valued at ₹220.50 crore, will close today for public subscription after receiving a strong response from investors, with the subscription rate reaching 50.63 times.

Priced in the range of ₹279-294 per share, the IPO consists of a fresh issue of up to 75 lakh shares, with no offer-for-sale components. Investors can bid for a minimum of 50 equity shares and in multiples of 50 equity shares thereafter.

The offer follows the book-building process, with up to 50 per cent of the offer available for allocation to qualified institutional buyers, at least 15 per cent for non-institutional investors, and a minimum of 35 per cent for retail investors.

The IPO received bids for 26.58 crore shares against the offered 52.50 lakh shares. The Non-Institutional Investors and retail portions were oversubscribed 128.41 times and 43.51 times, respectively, while the Qualified Institutional Buyer Portion was subscribed 4.75 times.

Ahead of the IPO, Denta Water and Infra Solutions raised ₹66.15 crore from anchor investors, who were allocated 22.50 lakh shares at ₹294 per share. The anchor investors included both foreign and domestic Institutions such as Abakkus Diversified Alpha Fund-2, Persistent Growth Fund-Varsu India Growth Story Scheme 1, Rajasthan Global Securities Private Limited, and others.

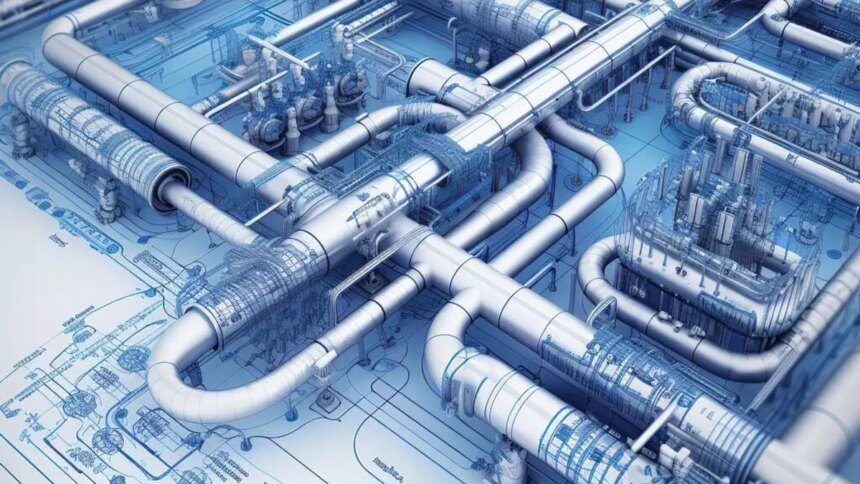

The company intends to use the net proceeds for working capital requirements and general corporate purposes. Denta Water and Infra Solutions specializes in designing, installing, and commissioning water management infrastructure projects, focusing on groundwater recharge projects and operations and maintenance services for projects lasting 3-5 years. The company also undertakes construction projects on railways and highways.

SMC Capitals is the sole book-running lead manager for the IPO, with Integrated Registry Management Services Private Ltd serving as the registrar.