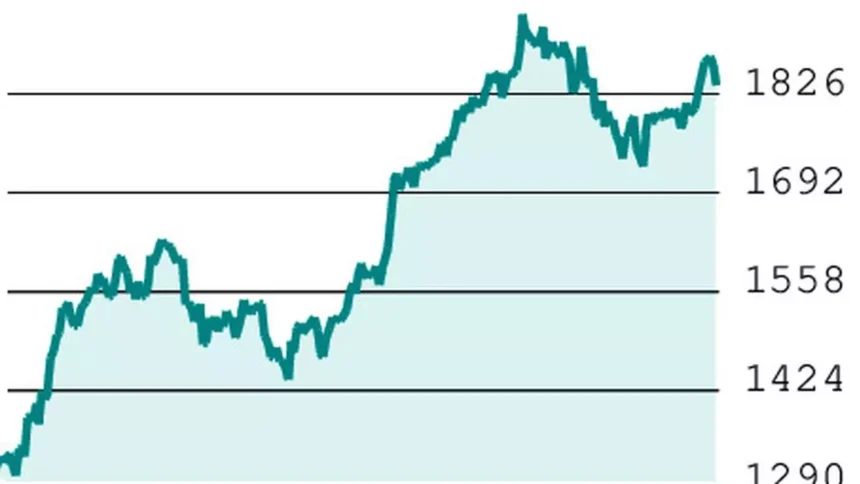

Sun Pharmaceutical Industries has been performing well in the market, with the stock showing signs of resuming its uptrend after a brief consolidation period. The breakout above the resistance at ₹1,830 indicates a bullish momentum, and the stock is likely to continue its upward trajectory.

Given the technical outlook, it is advisable to hold onto the Sun Pharmaceutical 1860-call option that you bought. The stock could potentially reach ₹1,950 in the near term, which would increase the value of your call option. If the stock price rises to ₹1,950 before the expiration of the January derivative contracts, the option premium could rise to ₹90, providing you with a good opportunity to profit.

However, it is important to monitor the stock closely and set a stop-loss at ₹38 to protect your investment in case the price movement turns unfavorable. If the stock breaks below the support level at ₹1,830, it may be wise to exit the option at the prevailing price to prevent further losses.

In the scenario where the stock does not reach the target price of ₹1,950 or drops due to time decay, it is recommended to have a stop-loss at a level that aligns with your risk tolerance and exit the trade accordingly. It is advisable not to hold onto the trade beyond January 20 to avoid potential losses.

Overall, based on the current market conditions and technical analysis, holding onto the Sun Pharmaceutical call option could yield positive results in the coming weeks. Keep a close eye on the stock price movements and adjust your strategy accordingly to maximize profits and minimize risks.