Last week saw a decline in the prices of gold and silver by 2.7 per cent and 3.9 per cent, respectively, with gold at $2,858/ounce and silver at $31.2/ounce.

In the domestic market, gold futures were down by 2.1 per cent at ₹84,219/10 gm, while silver futures lost 3.7 per cent at ₹94,328/kg.

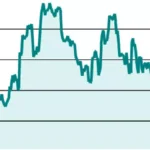

MCX-Gold

Gold futures (April) opened positively, reaching a high of ₹86,576 early last week but soon changed direction towards a considerable drop. Despite the support at ₹83,800, the current price action suggests a potential drop below this level to reach ₹82,400 this week. Further support lies at ₹81,000, with a breakout above ₹86,600 required for positive momentum to return. Resistance levels above ₹86,600 are at ₹90,000.

Trade strategy: Exit long positions at ₹84,800 and avoid short positions due to uncertainty in the extent of the drop.

MCX-Silver

Silver futures (May) declined last week, falling below support levels at ₹96,000 and ₹95,000 (rising trendline). The chart indicates the potential for further decline from the current level, with support at ₹92,000 and ₹89,000. A break below ₹89,000 could turn the outlook bearish. In case of a rally, resistance-turned-support is at ₹96,000, followed by barriers at ₹98,000 and ₹1,00,000.

Trade strategy: Short silver futures (May) at ₹95,400 with a stop-loss at ₹96,300 and book profits at ₹92,000.

Overall, gold and silver futures are expected to see a mix of drops and recoveries in the upcoming period.