India’s retail inflation jumped to a nine-month high of 5.5% in September, driven by higher food prices and an unfavorable base effect, according to official data released on Monday. This surge in consumer inflation from a low of 3.6% in July and 3.65% in August has dashed hopes of any immediate interest rate cuts.

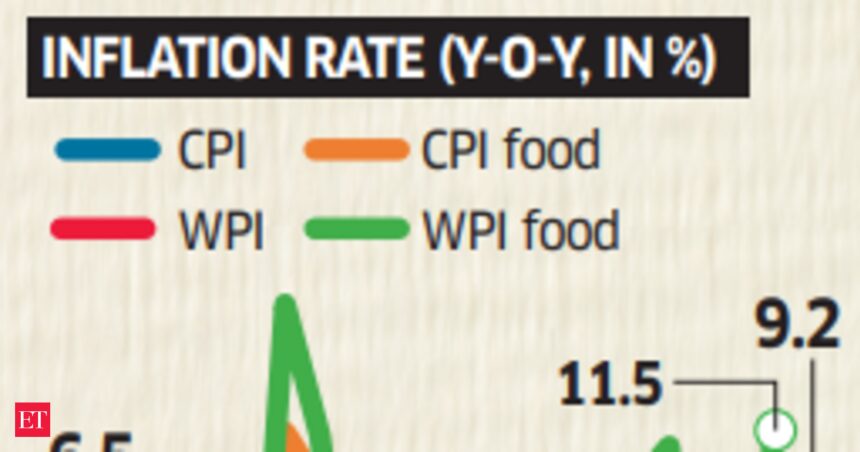

Food inflation rose to 9.24% in September from 5.66% in August, while wholesale inflation also increased to 1.84% from a four-month low of 1.31% in August. Economists believe that there is now a low probability of monetary easing for the remainder of the fiscal year. Even if there is a rate cut, it is likely to be symbolic and minimal.

The Reserve Bank of India (RBI) maintained the key rate at 6.5% during its latest Monetary Policy Committee meeting, but changed its stance to “neutral”, indicating the possibility of future rate adjustments. Experts predict that there may be a modest rate cut of 25 basis points in the upcoming December policy meeting, followed by another 25 basis points in February if food inflation moderates.

Inflation based on the Consumer Price Index (CPI) increased by 0.62% sequentially in September, with the food index rising by 1.04%. Rural and urban areas saw CPI inflation rates of 5.9% and 5.1% respectively. Core inflation, which excludes volatile fuel and food items and reflects demand pressures, reached an eight-month high of 3.5% in September.

Economists have warned that further escalation of conflict in West Asia could add to inflationary pressures. The share of imported inflation in the overall figure has also increased, with imported inflation growing by 2% in September, the highest reading in the last 13 months. Major contributors to imported inflation include gold, oils, fats, and chemical products.

The spike in food inflation was primarily attributed to the sharp increase in vegetable prices, which rose by 36% in September compared to 10.75% in the previous month.