Copper prices are expected to face challenges in 2025 due to various factors such as the potential re-election of Donald Trump as US President, a strong dollar, possible tariff wars, and setbacks in energy transition. Analysts have predicted a downward revision in the average annual copper price forecast to $10,000/tonne, citing these potential headwinds in the market.

The uncertainty surrounding potential US tariffs and a stronger dollar could contribute to further pressure on copper prices, impacting global commodity demand. However, there are contrasting views on the factors that could drive copper prices in the coming years. While some analysts highlight the growth in low-emission technology and data center deployment as key drivers for copper demand, others point to geopolitical uncertainties and geopolitical uncertainties as potential hurdles.

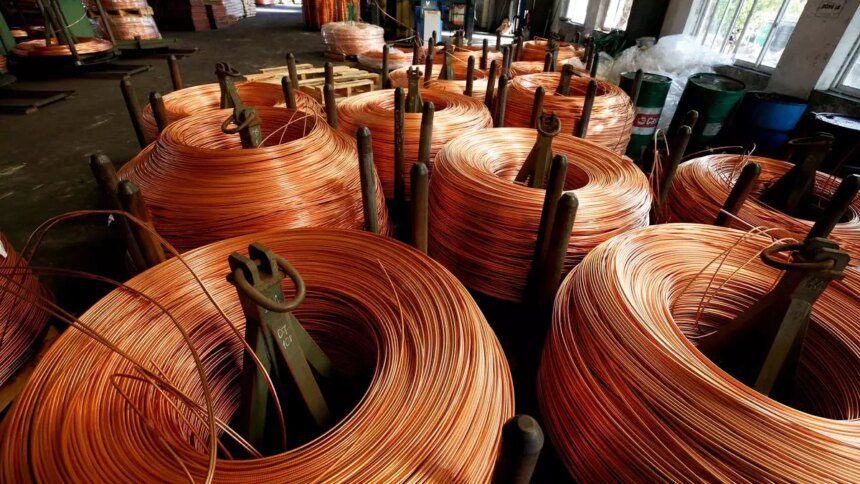

Capacity expansions in operating mines in Chile, Congo, and China are expected to drive global demand for copper. However, challenges such as declining ore grades, funding scarcity, and regulatory complexities could hinder growth in the sector. Global exchange-tracked stockpiles of copper remain high, indicating soft spot demand in key markets.

Geopolitical uncertainties, including the outcome of the US presidential election and potential tariff implications, are likely to continue influencing copper prices in the near term. Policies such as tax cuts, tariffs, and regulation changes could impact interest rates and global economic outlook, further affecting copper prices.

In conclusion, the future of copper prices in 2025 remains uncertain, with a mix of bullish and bearish factors shaping the market outlook. Monitoring key developments in geopolitics, trade policies, and technological advancements will be crucial in understanding the trajectory of copper prices in the coming years.